Abstract

Ein klassisches Buch zur Bewertung von Optionen ist

Les Clewlow and Chris Strickland: Implementing Derivatives Models (ISBN 0471966517)

Leider enthält dieses Buch eine Vielzahl von Fehlern, und die 8 Seiten lange Fehlerliste vom 23. November 2000 scheint auch nicht mehr öffentlich verfügbar zu sein.

Einige Fehlerkorrekturen für die erste Auflage:

| Page | Row | Correction |

|---|---|---|

| xvi | 9, column 3 | 0v should be C |

| 12 | 15 | Si,j = Su^jd^(n-j) |

| 24 | 2 from top in figure 2.12 | set coefficients |

| 70 | 4 from bottom in figure 3.13 | for j =Nj-2 downto -Nj+1 do |

| 70 | Insert before last row of figure 3.13 | C[1,-Nj] = C[1,-Nj + 1] - lambda_L |

| 75 | 4 from bottom in figure 3.16 | for j =Nj-2 downto -Nj+1 do |

| 75 | Insert before last row of figure 3.16 | C[1,-Nj] = C[1,-Nj + 1] - lambda_L |

| 85 | 2 from bottom in figure 4.2 | SD = sqrt( (-sum_CT2 + sum_CT * sum_CT / M ) ) * exp(-2rT) / (M - 1) |

| 89 | 2 from bottom in figure 4.5 | SD = sqrt( (-sum_CT2 + sum_CT * sum_CT / M ) ) * exp(-2rT) / (M - 1) |

| 99 | Delete row 9 from top | lnS = ln(S) = 4.6052 <- delete this row |

| 113 | 13 from top in figure 4.19 | Insert before for j loop V1 = sig1*sig1; V2 = sig2*sig2 |

| 113 | 18 from top in figure 4.19 | Insert before for i loop Vt1 = V1; Vt2 = V2 |

| 118 | Last row | a = m/N * ln(Gt) … |

| 120 | 11 from bottom in figure 4.24 | G = productSt ^(1/N) |

Ich implementierte einige der im Buch vorgestellten Algorithmen mit Excel VBA.

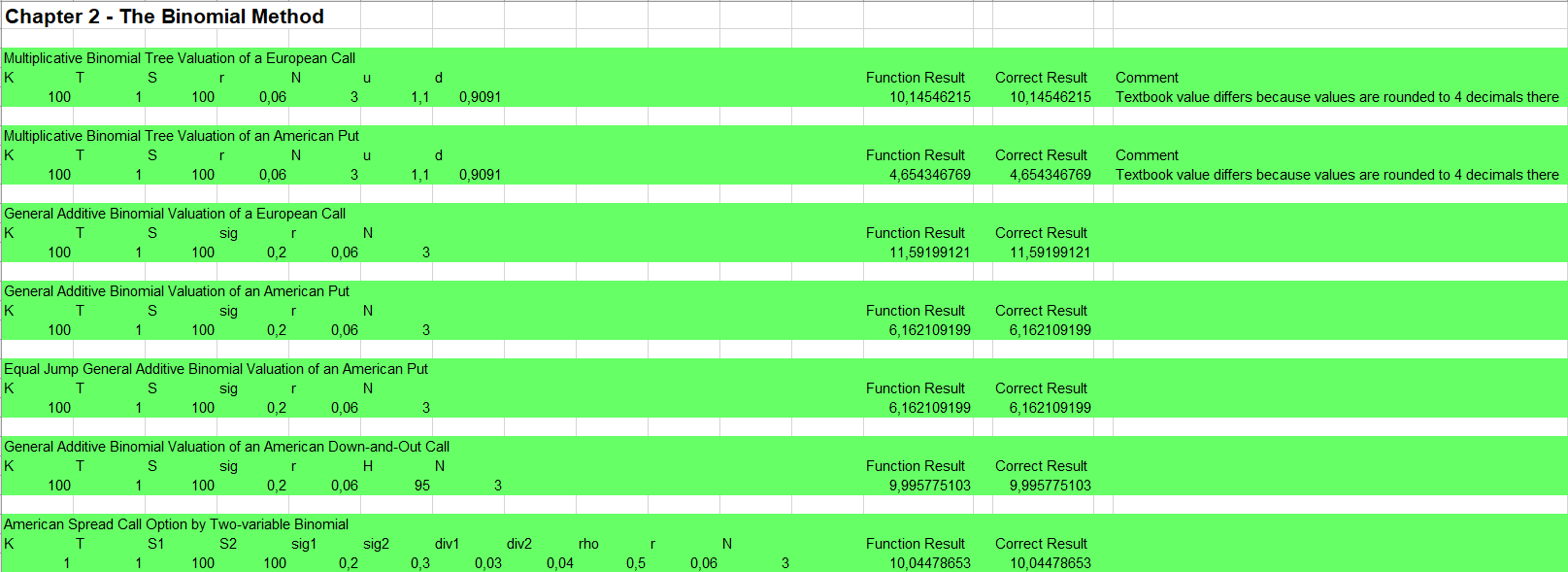

Das Binomialbaummodell

Bitte den Haftungsausschluss im Impressum beachten.

Function European_Call_MBTV(K As Double, T As Double, S As Double, _

r As Double, N As Long, u As Double, d As Double) As Double

'Multiplicative Binomial Tree Valuation of a European Call

'Clewlow/Strickland: Implementing Derivatives Models, page 13

'ISBN 0-471-96651-7

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double, p As Double, disc As Double

Dim i As Long, j As Long

ReDim St(0 To N) As Double, C(0 To N) As Double

'precompute constants

dt = T / N

p = (Exp(r * dt) - d) / (u - d)

disc = Exp(-r * dt)

'initialise asset prices at maturity time step N

St(0) = S * d ^ N

For j = 1 To N

St(j) = St(j - 1) * u / d

Next j

'initialise option values at maturity

For j = 0 To N

C(j) = St(j) - K: If C(j) < 0# Then C(j) = 0#

Next j

'step back through the tree

For i = N - 1 To 0 Step -1

For j = 0 To i

C(j) = disc * (p * C(j + 1) + (1 - p) * C(j))

Next j

Next i

European_Call_MBTV = C(0)

End Function

Function American_Put_MBTV(K As Double, T As Double, S As Double, _

r As Double, N As Long, u As Double, d As Double) As Double

'Multiplicative Binomial Tree Valuation of an American Put

'Clewlow/Strickland: Implementing Derivatives Models, page 15

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim i As Long, j As Long

Dim dt As Double, p As Double, disc As Double

ReDim St(0 To N) As Double, C(0 To N) As Double

'precompute constants

dt = T / N

p = (Exp(r * dt) - d) / (u - d)

disc = Exp(-r * dt)

'initialise asset prices at maturity time step N

St(0) = S * d ^ N

For j = 1 To N

St(j) = St(j - 1) * u / d

Next j

'initialise option values at maturity

For j = 0 To N

C(j) = K - St(j): If C(j) < 0# Then C(j) = 0#

Next j

'step back through the tree applying the early exercise condition

For i = N - 1 To 0 Step -1

For j = 0 To i

C(j) = disc * (p * C(j + 1) + (1 - p) * C(j))

St(j) = St(j) / d

If C(j) < K - St(j) Then C(j) = K - St(j)

Next j

Next i

American_Put_MBTV = C(0)

End Function

Function European_Call_GABV(K As Double, T As Double, S As Double, _

sig As Double, r As Double, N As Long) As Double

'General Additive Binomial Valuation of a European Call

'Clewlow/Strickland: Implementing Derivatives Models, page 22

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim i As Long, j As Long

Dim dt As Double, pu As Double, pd As Double

Dim dxu As Double, dxd As Double, nu As Double, disc As Double

ReDim St(0 To N) As Double, C(0 To N) As Double

'set coefficients - Trigeorgis

dt = T / N

nu = r - 0.5 * sig ^ 2#

dxu = Sqr(sig ^ 2# * dt + (nu * dt) ^ 2#)

dxd = -dxu

pu = 0.5 + 0.5 * (nu * dt / dxu)

pd = 1# - pu

'precompute constants

disc = Exp(-r * dt)

'initialise asset prices at maturity N

St(0) = S * Exp(N * dxd)

For j = 1 To N

St(j) = St(j - 1) * Exp(dxu - dxd)

Next j

'initialise option values at maturity

For j = 0 To N

C(j) = St(j) - K: If C(j) < 0# Then C(j) = 0#

Next j

'step back through the tree

For i = N - 1 To 0 Step -1

For j = 0 To i

C(j) = disc * (pu * C(j + 1) + pd * C(j))

Next j

Next i

European_Call_GABV = C(0)

End Function

Function American_Put_GABV(K As Double, T As Double, S As Double, _

sig As Double, r As Double, N As Long) As Double

'General Additive Binomial Valuation of an American Put

'Clewlow/Strickland: Implementing Derivatives Models, page 24

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim i As Long, j As Long

Dim dt As Double, pu As Double, pd As Double

Dim dxu As Double, dxd As Double, nu As Double, disc As Double

ReDim St(0 To N) As Double, C(0 To N) As Double

'set coefficients - Trigeorgis

dt = T / N

nu = r - 0.5 * sig ^ 2#

dxu = Sqr(sig ^ 2 * dt + (nu * dt) ^ 2#)

dxd = -dxu

pu = 0.5 + 0.5 * (nu * dt / dxu)

pd = 1# - pu

'precompute constants

disc = Exp(-r * dt)

'initialise asset prices at maturity N

St(0) = S * Exp(N * dxd)

For j = 1 To N

St(j) = St(j - 1) * Exp(dxu - dxd)

Next j

'initialise option values at maturity

For j = 0 To N

C(j) = K - St(j): If C(j) < 0# Then C(j) = 0#

Next j

'step back through the tree applying the early exercise condition

For i = N - 1 To 0 Step -1

For j = 0 To i

C(j) = disc * (pu * C(j + 1) + pd * C(j))

'adjust asset price to current time step

St(j) = St(j) / Exp(dxd)

'apply the early exercise condition

If K - St(j) > C(j) Then C(j) = K - St(j)

Next j

Next i

American_Put_GABV = C(0)

End Function

Function American_Put_EJGABV(K As Double, T As Double, S As Double, _

sig As Double, r As Double, N As Long) As Double

'Equal Jump General Additive Binomial Valuation of an American Put

'Clewlow/Strickland: Implementing Derivatives Models, page 28

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim i As Long, j As Long

Dim dt As Double, pu As Double, pd As Double, dx As Double

Dim nu As Double, disc As Double, edx As Double

Dim dpu As Double, dpd As Double

ReDim St(-N To N) As Double, C(-N To N) As Double

'set coefficients - Trigeorgis

dt = T / N

nu = r - 0.5 * sig ^ 2#

dx = Sqr(sig ^ 2# * dt + (nu * dt) ^ 2#)

pu = 0.5 + 0.5 * (nu * dt / dx)

pd = 1# - pu

'precompute constants

disc = Exp(-r * dt)

dpu = disc * pu

dpd = disc * pd

edx = Exp(dx)

'initialise asset prices at maturity N

St(-N) = S * Exp(-N * dx)

For j = -N + 1 To N

St(j) = St(j - 1) * edx

Next j

'initialise option values at maturity

For j = -N To N Step 2

C(j) = K - St(j): If C(j) < 0# Then C(j) = 0#

Next j

'step back through the tree applying the early exercise condition

For i = N - 1 To 0 Step -1

For j = -i To i Step 2

C(j) = dpd * C(j - 1) + dpu * C(j + 1)

'apply the early exercise condition

If K - St(j) > C(j) Then C(j) = K - St(j)

Next j

Next i

American_Put_EJGABV = C(0)

End Function

Function American_Down_and_Out_Call_GABV( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

H As Double, _

N As Long) As Double

'General Additive Binomial Valuation of an American Down-and-Out Call

'Clewlow/Strickland: Implementing Derivatives Models, page 41

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pd As Double

Dim dpu As Double, dpd As Double

Dim dxd As Double, dxu As Double, nu As Double

Dim edxud As Double

Dim edxd As Double

Dim disc As Double

ReDim St(0 To N) As Double

ReDim C(0 To N) As Double

Dim i As Long, j As Long

'set coefficients - Trigeorgis

dt = T / N

nu = r - 0.5 * sig ^ 2#

dxu = Sqr(sig ^ 2# * dt + (nu * dt) ^ 2#)

dxd = -dxu

pu = 0.5 + 0.5 * (nu * dt / dxu)

pd = 1# - pu

'precompute constants

disc = Exp(-r * dt)

dpu = disc * pu

dpd = disc * pd

edxud = Exp(dxu - dxd)

edxd = Exp(dxd)

'initialise asset prices at maturity N

St(0) = S * Exp(N * dxd)

For j = 1 To N

St(j) = St(j - 1) * edxud

Next j

'initialise option values at maturity

For j = 0 To N

If St(j) > H Then

C(j) = St(j) - K: If C(j) < 0# Then C(j) = 0#

Else

C(j) = 0#

End If

Next j

'step back through the tree applying the barrier

'and early exercise condition

For i = N - 1 To 0 Step -1

For j = 0 To i

'adjust asset price to current time step

St(j) = St(j) / edxd

If St(j) > H Then

C(j) = dpd * C(j) + dpu * C(j + 1)

'apply the early exercise condition

If C(j) < St(j) - K Then C(j) = St(j) - K

Else

C(j) = 0#

End If

Next j

Next i

American_Down_and_Out_Call_GABV = C(0)

End Function

Function American_Spread_Call_Option_bTvB( _

K As Double, _

T As Double, _

S1 As Double, _

S2 As Double, _

sig1 As Double, _

sig2 As Double, _

div1 As Double, _

div2 As Double, _

rho As Double, _

r As Double, _

N As Long) As Double

'American Spread Call Option by Two-variable Binomial

'Clewlow/Strickland: Implementing Derivatives Models, page 46

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim puu As Double, pdu As Double

Dim pud As Double, pdd As Double

Dim dx1 As Double, dx2 As Double

Dim nu1 As Double, nu2 As Double

Dim edx1 As Double, edx2 As Double

Dim disc As Double

ReDim s1t(-N To N) As Double

ReDim s2t(-N To N) As Double

ReDim C(-N To N, -N To N) As Double

Dim i As Long, j As Long, k1 As Long

'precompute constants

dt = T / N

nu1 = r - div1 - 0.5 * sig1 ^ 2#

nu2 = r - div2 - 0.5 * sig2 ^ 2#

dx1 = sig1 * Sqr(dt)

dx2 = sig2 * Sqr(dt)

disc = Exp(-r * dt)

puu = (dx1 * dx2 + (dx2 * nu1 + dx1 * nu2 + rho * sig1 * sig2) * dt) / _

(4 * dx1 * dx2) * disc

pud = (dx1 * dx2 + (dx2 * nu1 - dx1 * nu2 - rho * sig1 * sig2) * dt) / _

(4 * dx1 * dx2) * disc

pdu = (dx1 * dx2 - (dx2 * nu1 - dx1 * nu2 + rho * sig1 * sig2) * dt) / _

(4 * dx1 * dx2) * disc

pdd = (dx1 * dx2 - (dx2 * nu1 + dx1 * nu2 - rho * sig1 * sig2) * dt) / _

(4 * dx1 * dx2) * disc

edx1 = Exp(dx1)

edx2 = Exp(dx2)

'initialise asset prices at time step N

s1t(-N) = S1 * Exp(-N * dx1)

s2t(-N) = S2 * Exp(-N * dx2)

For j = -N + 1 To N

s1t(j) = s1t(j - 1) * edx1

s2t(j) = s2t(j - 1) * edx2

Next j

'initialise option values at maturity

For j = -N To N Step 2

For k1 = -N To N Step 2

C(j, k1) = s1t(j) - s2t(k1) - K

If C(j, k1) < 0# Then C(j, k1) = 0#

Next k1

Next j

'step back through the tree applying the early exercise condition

For i = N - 1 To 0 Step -1

For j = -i To i Step 2

For k1 = -i To i Step 2

C(j, k1) = pdd * C(j - 1, k1 - 1) + pud * C(j + 1, k1 - 1) + _

pdu * C(j - 1, k1 + 1) + puu * C(j + 1, k1 + 1)

'apply the early exercise condition

If s1t(j) - s2t(k1) - K > C(j, k1) Then C(j, k1) = s1t(j) - s2t(k1) - K

Next k1

Next j

Next i

American_Spread_Call_Option_bTvB = C(0, 0)

End Function

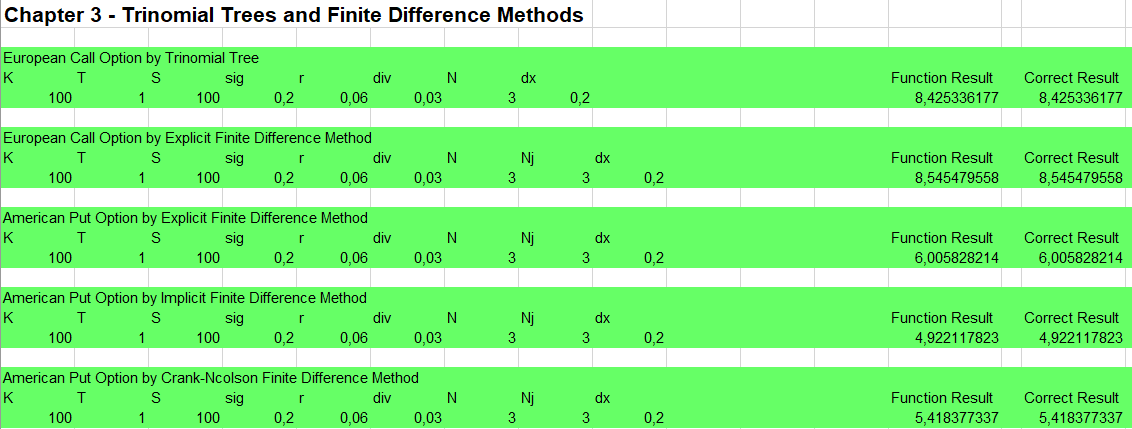

Das Trinomial-Optionspreismodell und die Methode der Finiten Differenzen

Bitte den Haftungsausschluss im Impressum beachten.

Function European_Call_Option_bTT( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

dx As Double) As Double

'European Call Option by Trinomial Tree

'Clewlow/Strickland: Implementing Derivatives Models, page 54

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pm As Double, pd As Double

Dim nu As Double, edx As Double

Dim disc As Double

ReDim St(-N To N) As Double

ReDim C(0 To N, -N To N) As Double

Dim i As Long, j As Long

'set coefficients - Trigeorgis

dt = T / N

nu = r - div - 0.5 * sig ^ 2#

edx = Exp(dx)

pu = 0.5 * ((sig ^ 2# * dt + nu ^ 2# * dt ^ 2#) / dx ^ 2# + nu * dt / dx)

pm = 1# - (sig ^ 2# * dt + nu ^ 2# * dt ^ 2#) / dx ^ 2#

pd = 0.5 * ((sig ^ 2# * dt + nu ^ 2# * dt ^ 2#) / dx ^ 2# - nu * dt / dx)

disc = Exp(-r * dt)

'initialise asset prices at maturity N

St(-N) = S * Exp(-N * dx)

For j = -N + 1 To N

St(j) = St(j - 1) * edx

Next j

'initialise option values at maturity

For j = -N To N

If St(j) - K > 0# Then

C(N, j) = St(j) - K

Else

C(N, j) = 0#

End If

Next j

'step back through lattice

For i = N - 1 To 0 Step -1

For j = -i To i

C(i, j) = disc * (pu * C(i + 1, j + 1) + pm * C(i + 1, j) + pd * C(i + 1, j - 1))

Next j

Next i

European_Call_Option_bTT = C(0, 0)

End Function

Function European_Call_Option_bEFDM( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

Nj As Long, _

dx As Double) As Double

'European Call Option by Explicit Finite Difference Method

'Clewlow/Strickland: Implementing Derivatives Models, page 60

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pm As Double, pd As Double

Dim nu As Double, edx As Double

ReDim St(-Nj To Nj) As Double

ReDim C(0 To N, -Nj To Nj) As Double

Dim i As Long, j As Long

'set coefficients - Trigeorgis

dt = T / N

nu = r - div - 0.5 * sig ^ 2#

edx = Exp(dx)

pu = 0.5 * dt * ((sig / dx) ^ 2# + nu / dx)

pm = 1# - dt * ((sig / dx) ^ 2# + r)

pd = 0.5 * dt * ((sig / dx) ^ 2# - nu / dx)

'initialise asset prices at maturity N

St(-Nj) = S * Exp(-Nj * dx)

For j = -Nj + 1 To Nj

St(j) = St(j - 1) * edx

Next j

'initialise option values at maturity

For j = -Nj To Nj

If St(j) - K > 0# Then

C(N, j) = St(j) - K

Else

C(N, j) = 0#

End If

Next j

'step back through lattice

For i = N - 1 To 0 Step -1

For j = -Nj + 1 To Nj - 1

C(i, j) = pu * C(i + 1, j + 1) + pm * C(i + 1, j) + pd * C(i + 1, j - 1)

Next j

'boundary conditions

C(i, -Nj) = C(i, -Nj + 1)

C(i, Nj) = C(i, Nj - 1) + St(Nj) - St(Nj - 1)

Next i

European_Call_Option_bEFDM = C(0, 0)

End Function

Function American_Put_Option_bEFDM( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

Nj As Long, _

dx As Double) As Double

'American Put Option by Explicit Finite Difference Method

'Clewlow/Strickland: Implementing Derivatives Models, page 62

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pm As Double, pd As Double

Dim nu As Double, edx As Double

ReDim St(-Nj To Nj) As Double

ReDim C(0 To 1, -Nj To Nj) As Double

Dim i As Long, j As Long

'Precompute constants

dt = T / N

nu = r - div - 0.5 * sig ^ 2#

edx = Exp(dx)

pu = 0.5 * dt * ((sig / dx) ^ 2# + nu / dx)

pm = 1# - dt * (sig / dx) ^ 2# - r * dt

pd = 0.5 * dt * ((sig / dx) ^ 2# - nu / dx)

'Initialise asset prices at maturity N

St(-Nj) = S * Exp(-Nj * dx)

For j = -Nj + 1 To Nj

St(j) = St(j - 1) * edx

Next j

'Initialise option values at maturity

For j = -Nj To Nj

If K - St(j) > 0# Then

C(0, j) = K - St(j)

Else

C(0, j) = 0#

End If

Next j

'Step back through lattice

For i = N - 1 To 0 Step -1

For j = -Nj + 1 To Nj - 1

C(1, j) = pu * C(0, j + 1) + pm * C(0, j) + pd * C(0, j - 1)

Next j

'Boundary conditions

C(1, -Nj) = C(1, -Nj + 1) + St(-Nj + 1) - St(-Nj)

C(1, Nj) = C(1, Nj - 1)

'Apply early exercise condition

For j = -Nj To Nj

C(0, j) = K - St(j)

If C(0, j) < C(1, j) Then C(0, j) = C(1, j)

Next j

Next i

American_Put_Option_bEFDM = C(0, 0)

End Function

Function American_Put_Option_bIFDM( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

Nj As Long, _

dx As Double) As Double

'American Put Option by Implicit Finite Difference Method

'Clewlow/Strickland: Implementing Derivatives Models, page 69

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pm As Double, pd As Double

Dim nu As Double, edx As Double

Dim lambda_L As Double, lambda_U As Double

ReDim St(-Nj To Nj) As Double

ReDim C(0 To 1, -Nj To Nj) As Double

Dim i As Long, j As Long

ReDim pmp(-Nj To Nj) As Double

ReDim pp(-Nj To Nj) As Double

'Precompute constants

dt = T / N

nu = r - div - 0.5 * sig ^ 2#

edx = Exp(dx)

pu = -0.5 * dt * ((sig / dx) ^ 2# + nu / dx)

pm = 1# + dt * (sig / dx) ^ 2# + r * dt

pd = -0.5 * dt * ((sig / dx) ^ 2# - nu / dx)

'Initialise asset prices at maturity N

St(-Nj) = S * Exp(-Nj * dx)

For j = -Nj + 1 To Nj

St(j) = St(j - 1) * edx

Next j

'Initialise option values at maturity

For j = -Nj To Nj

If K - St(j) > 0# Then

C(0, j) = K - St(j)

Else

C(0, j) = 0#

End If

Next j

'Compute derivative boundary condition

lambda_L = St(-Nj) - St(-Nj + 1)

lambda_U = 0#

'Step back through lattice

For i = N - 1 To 0 Step -1

'Solve implicit tridiagonal system

'Substitute boundary condition at j = -Nj into j = -Nj + 1

pmp(-Nj + 1) = pm + pd

pp(-Nj + 1) = C(0, -Nj + 1) + pd * lambda_L

'Eliminate upper diagonal

For j = -Nj + 2 To Nj - 1

pmp(j) = pm - pu * pd / pmp(j - 1)

pp(j) = C(0, j) - pp(j - 1) * pd / pmp(j - 1)

Next j

'Use boundary condition at j = Nj and equation at j = Nj - 1

C(1, Nj) = (pp(Nj - 1) + pmp(Nj - 1) * lambda_U) / (pu + pmp(Nj - 1))

C(1, Nj - 1) = C(1, Nj) - lambda_U

'Back-substitution

For j = Nj - 2 To -Nj + 1 Step -1

C(1, j) = (pp(j) - pu * C(1, j + 1)) / pmp(j)

Next j

C(1, -Nj) = C(1, -Nj + 1) - lambda_L

'Apply early exercise condition

For j = -Nj To Nj

C(0, j) = K - St(j)

If C(0, j) < C(1, j) Then C(0, j) = C(1, j)

Next j

Next i

American_Put_Option_bIFDM = C(0, 0)

End Function

Function American_Put_Option_bCNFDM( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

Nj As Long, _

dx As Double) As Double

'American Put Option by Crank-Nicolson Finite Difference Method

'Clewlow/Strickland: Implementing Derivatives Models, page 74

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim pu As Double, pm As Double, pd As Double

Dim nu As Double, edx As Double

Dim lambda_L As Double, lambda_U As Double

ReDim St(-Nj To Nj) As Double

ReDim C(0 To 1, -Nj To Nj) As Double

Dim i As Long, j As Long

ReDim pmp(-Nj To Nj) As Double

ReDim pp(-Nj To Nj) As Double

'Precompute constants

dt = T / N

nu = r - div - 0.5 * sig ^ 2#

edx = Exp(dx)

pu = -0.25 * dt * ((sig / dx) ^ 2# + nu / dx)

pm = 1# + 0.5 * dt * (sig / dx) ^ 2# + 0.5 * r * dt

pd = -0.25 * dt * ((sig / dx) ^ 2# - nu / dx)

'Initialise asset prices at maturity N

St(-Nj) = S * Exp(-Nj * dx)

For j = -Nj + 1 To Nj

St(j) = St(j - 1) * edx

Next j

'Initialise option values at maturity

For j = -Nj To Nj

If K - St(j) > 0# Then

C(0, j) = K - St(j)

Else

C(0, j) = 0#

End If

Next j

'Compute derivative boundary condition

lambda_L = St(-Nj) - St(-Nj + 1)

lambda_U = 0#

'Step back through lattice

For i = N - 1 To 0 Step -1

'Solve Crank-Nicolson tridiagonal system

'Substitute boundary condition at j = -Nj into j = -Nj + 1

pmp(-Nj + 1) = pm + pd

pp(-Nj + 1) = -pu * C(0, -Nj + 2) - (pm - 2) * C(0, -Nj + 1) - pd * C(0, -Nj) + pd * lambda_L

'Eliminate upper diagonal

For j = -Nj + 2 To Nj - 1

pmp(j) = pm - pu * pd / pmp(j - 1)

pp(j) = -pu * C(0, j + 1) - (pm - 2) * C(0, j) - pd * C(0, j - 1) - pp(j - 1) * pd / pmp(j - 1)

Next j

'Use boundary condition at j = Nj and equation at j = Nj - 1

C(1, Nj) = (pp(Nj - 1) + pmp(Nj - 1) * lambda_U) / (pu + pmp(Nj - 1))

C(1, Nj - 1) = C(1, Nj) - lambda_U

'Back-substitution

For j = Nj - 2 To -Nj + 1 Step -1

C(1, j) = (pp(j) - pu * C(1, j + 1)) / pmp(j)

Next j

C(1, -Nj) = C(1, -Nj + 1) - lambda_L

'Apply early exercise condition

For j = -Nj To Nj

C(0, j) = K - St(j)

If C(0, j) < C(1, j) Then C(0, j) = C(1, j)

Next j

Next i

American_Put_Option_bCNFDM = C(0, 0)

End Function

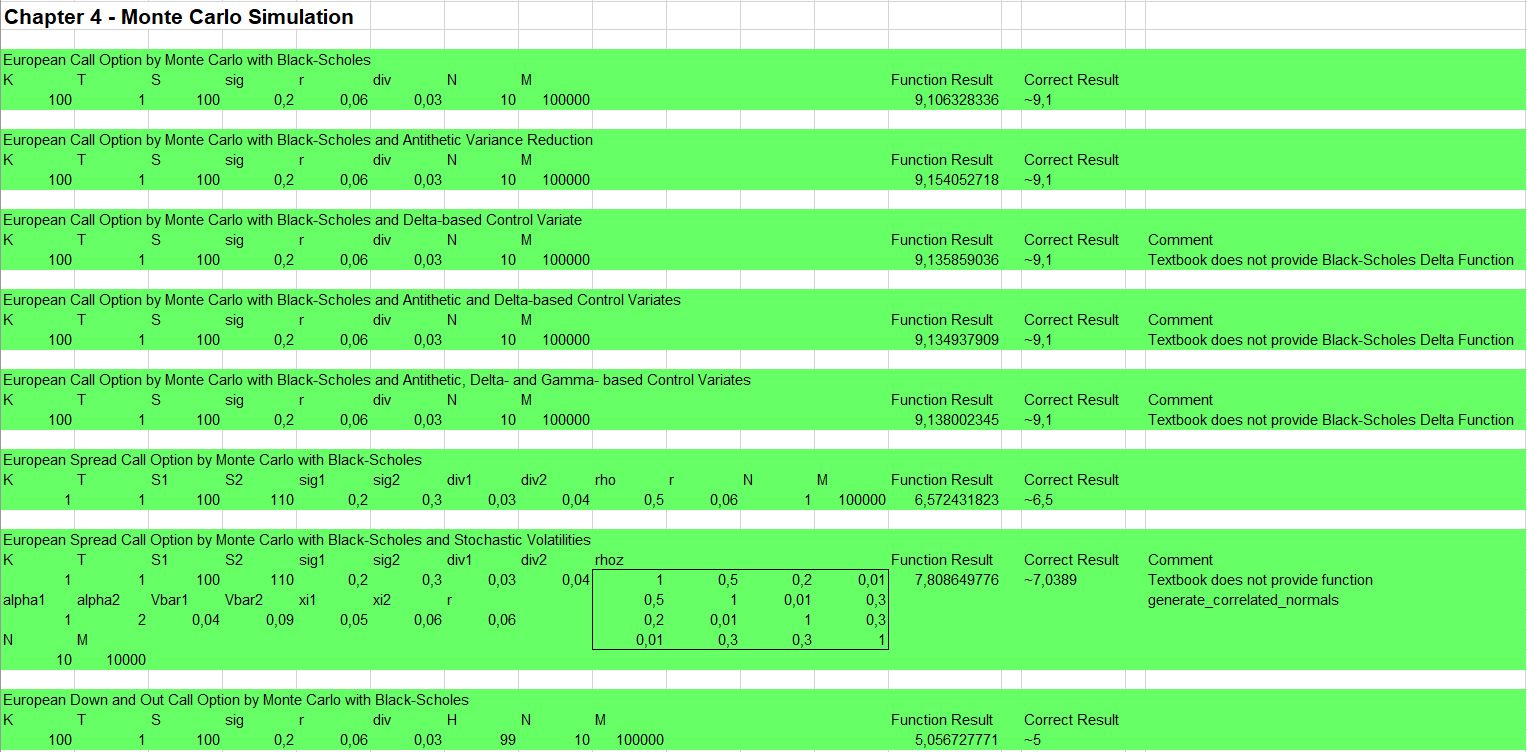

Monte Carlo Simulation

Bitte den Haftungsausschluss im Impressum beachten.

Function European_Call_bMCBS( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

M As Long) As Double

'European Call Option by Monte Carlo with Black-Scholes

'Clewlow/Strickland: Implementing Derivatives Models, page 85

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.1

Dim dt As Double

Dim nudt As Double, sigsdt As Double

Dim lnS As Double, lnSt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St As Double, CT As Double

Dim SD As Double, SE As Double

Dim i As Long, j As Long

'Precompute constants

dt = T / N

nudt = (r - div - 0.5 * sig ^ 2#) * dt

sigsdt = sig * Sqr(dt)

lnS = Log(S)

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

lnSt = lnS

For i = 1 To N

'For each time step

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

lnSt = lnSt + nudt + sigsdt * e 'Evolve the stock price

Next i

St = Exp(lnSt)

CT = St - K: If CT < 0# Then CT = 0#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT2 + CT * CT

Next j

SD = Sqr(sum_CT2 - sum_CT * sum_CT / M) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Call_bMCBS = sum_CT / M * Exp(-r * T)

End Function

Function European_Call_bMCBS_AVR( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

M As Long) As Double

'European Call Option by Monte Carlo with Black-Scholes and Antithetic Variance Reduction

'Clewlow/Strickland: Implementing Derivatives Models, page 89

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nudt As Double, sigsdt As Double

Dim lnS As Double, LnSt1 As Double, LnSt2 As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St1 As Double, St2 As Double

Dim CT As Double, CT1 As Double, CT2 As Double

Dim SD As Double, SE As Double

Dim i As Long, j As Long

'Precompute constants

dt = T / N

nudt = (r - div - 0.5 * sig ^ 2#) * dt

sigsdt = sig * Sqr(dt)

lnS = Log(S)

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

LnSt1 = lnS

LnSt2 = lnS

For i = 1 To N

'For each time step

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

LnSt1 = LnSt1 + nudt + sigsdt * e 'Evolve the stock price

LnSt2 = LnSt2 + nudt + sigsdt * -e 'Evolve the stock price

Next i

St1 = Exp(LnSt1)

St2 = Exp(LnSt2)

CT1 = St1 - K: If CT1 < 0# Then CT1 = 0#

CT2 = St2 - K: If CT2 < 0# Then CT2 = 0#

CT = (CT1 + CT2) / 2#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Call_bMCBS_AVR = sum_CT / M * Exp(-r * T)

End Function

Function European_Call_bMCBS_DCV( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

M As Long) As Double

'European Call Option by Monte Carlo with Black-Scholes and Delta-based Control Variate

'Clewlow/Strickland: Implementing Derivatives Models, page 97

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nudt As Double, sigsdt As Double, erddt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St As Double, Stn As Double

Dim CT As Double

Dim SD As Double, SE As Double

Dim beta1 As Double, t1 As Double

Dim cv As Double

Dim delta1 As Double

Dim i As Long, j As Long

'Dim eps As Variant

'eps = Array(0.5391, 0.1692, 0.4583, 0.4164, 0.9223, 0.1597, 0.4011, -0.2382, 1.2152, -0.5506)

'Precompute constants

dt = T / N

nudt = (r - div - 0.5 * sig ^ 2#) * dt

sigsdt = sig * Sqr(dt)

erddt = Exp((r - div) * dt)

beta1 = -1#

'Debug.Print "dt = " & dt & ", nudt = " & nudt & ", sigsdt = " & sigsdt & ", erddt = " & erddt & ", beta1 = " & beta1

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

St = S

cv = 0#

For i = 1 To N

'For each time step

t1 = CDbl(i - 1) * dt

delta1 = Black_Scholes_Delta(St, t1, K, T, sig, r, div)

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

' e = eps(i - 1)

Stn = St * Exp(nudt + sigsdt * e)

cv = cv + delta1 * (Stn - St * erddt) '* exp(T - (t1 + dt)) 'inflation factor *exp can be omitted

St = Stn

Next i

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

CT = St - K: If CT < 0# Then CT = 0#

CT = CT + beta1 * cv

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

' Debug.Print "CT = " & CT & ", CT2 = " & CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Call_bMCBS_DCV = sum_CT / M * Exp(-r * T)

End Function

Function European_Call_bMCBS_ADCV( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

M As Long) As Double

'European Call Option by Monte Carlo with Black-Scholes and Antithetic and Delta-based Control Variates

'Clewlow/Strickland: Implementing Derivatives Models, page 100

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nudt As Double, sigsdt As Double, erddt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St1 As Double, Stn1 As Double

Dim St2 As Double, Stn2 As Double

Dim CT As Double, CT1 As Double, CT2 As Double

Dim SD As Double, SE As Double

Dim beta1 As Double, t1 As Double

Dim cv1 As Double, cv2 As Double

Dim delta1 As Double, delta2 As Double

Dim i As Long, j As Long

'Dim eps As Variant

'eps = Array(0.5391, 0.1692, 0.4583, 0.4164, 0.9223, 0.1597, 0.4011, -0.2382, 1.2152, -0.5506)

'Precompute constants

dt = T / N

nudt = (r - div - 0.5 * sig ^ 2#) * dt

sigsdt = sig * Sqr(dt)

erddt = Exp((r - div) * dt)

beta1 = -1#

'Debug.Print "dt = " & dt & ", nudt = " & nudt & ", sigsdt = " & sigsdt & ", erddt = " & erddt & ", beta1 = " & beta1

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

St1 = S

St2 = S

cv1 = 0#

cv2 = 0#

For i = 1 To N

'For each time step

t1 = CDbl(i - 1) * dt

delta1 = Black_Scholes_Delta(St1, t1, K, T, sig, r, div)

delta2 = Black_Scholes_Delta(St2, t1, K, T, sig, r, div)

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

' e = eps(i - 1)

Stn1 = St1 * Exp(nudt + sigsdt * e)

Stn2 = St2 * Exp(nudt + sigsdt * -e)

cv1 = cv1 + delta1 * (Stn1 - St1 * erddt) '* exp(T - (t1 + dt)) 'inflation factor *exp can be omitted

cv2 = cv2 + delta2 * (Stn2 - St2 * erddt) '* exp(T - (t1 + dt)) 'inflation factor *exp can be omitted

St1 = Stn1

St2 = Stn2

Next i

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

CT1 = St1 - K: If CT1 < 0# Then CT1 = 0#

CT2 = St2 - K: If CT2 < 0# Then CT2 = 0#

CT = (CT1 + beta1 * cv1 + CT2 + beta1 * cv2) / 2#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

' Debug.Print "CT = " & CT & ", CT2 = " & CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Call_bMCBS_ADCV = sum_CT / M * Exp(-r * T)

End Function

Function European_Call_bMCBS_ADGCV( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

N As Long, _

M As Long) As Double

'European Call Option by Monte Carlo with Black-Scholes and Antithetic, Delta-

'and Gamma-based Control Variates

'Clewlow/Strickland: Implementing Derivatives Models, page 102

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nudt As Double, sigsdt As Double

Dim erddt As Double, egamma As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St1 As Double, Stn1 As Double

Dim St2 As Double, Stn2 As Double

Dim CT As Double, CT1 As Double, CT2 As Double

Dim SD As Double, SE As Double

Dim beta1 As Double, beta2 As Double, t1 As Double

Dim cv1 As Double, cv2 As Double

Dim delta1 As Double, delta2 As Double

Dim gamma1 As Double, gamma2 As Double

Dim i As Long, j As Long

'Dim eps As Variant

'eps = Array(0.5391, 0.1692, 0.4583, 0.4164, 0.9223, 0.1597, 0.4011, -0.2382, 1.2152, -0.5506)

'Precompute constants

dt = T / N

nudt = (r - div - 0.5 * sig ^ 2#) * dt

sigsdt = sig * Sqr(dt)

erddt = Exp((r - div) * dt)

egamma = Exp((2# * (r - div) + sig * sig) * dt) - 2# * erddt + 1#

beta1 = -1#

beta2 = -0.5

'Debug.Print "dt = " & dt & ", nudt = " & nudt & ", sigsdt = " & sigsdt & ", erddt = " & erddt & ", beta1 = " & beta1

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

St1 = S

St2 = S

cv1 = 0#

cv2 = 0#

For i = 1 To N

'For each time step

'Compute hedge sensitivities

t1 = CDbl(i - 1) * dt

delta1 = Black_Scholes_Delta(St1, t1, K, T, sig, r, div)

delta2 = Black_Scholes_Delta(St2, t1, K, T, sig, r, div)

gamma1 = Black_Scholes_Gamma(St1, t1, K, T, sig, r, div)

gamma2 = Black_Scholes_Gamma(St2, t1, K, T, sig, r, div)

'Evolve asset prices

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

' e = eps(i - 1)

Stn1 = St1 * Exp(nudt + sigsdt * e)

Stn2 = St2 * Exp(nudt + sigsdt * -e)

'Accumulate control variates

cv1 = cv1 + delta1 * (Stn1 - St1 * erddt) + _

delta2 * (Stn2 - St2 * erddt)

cv2 = cv2 + gamma1 * ((Stn1 - St1) ^ 2 - St1 ^ 2 * egamma) + _

gamma2 * ((Stn2 - St2) ^ 2 - St2 ^ 2 * egamma)

St1 = Stn1

St2 = Stn2

Next i

' Debug.Print "e = " & e & ", St = " & St & ", delta1 = " & delta1 & ", cv = " & cv

CT1 = St1 - K: If CT1 < 0# Then CT1 = 0#

CT2 = St2 - K: If CT2 < 0# Then CT2 = 0#

CT = (CT1 + CT2 + beta1 * cv1 + beta2 * cv2) / 2#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

' Debug.Print "CT = " & CT & ", CT2 = " & CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Call_bMCBS_ADGCV = sum_CT / M * Exp(-r * T)

End Function

Function European_Spread_bMCBS( _

K As Double, _

T As Double, _

S1 As Double, _

S2 As Double, _

sig1 As Double, _

sig2 As Double, _

div1 As Double, _

div2 As Double, _

rho As Double, _

r As Double, _

N As Long, _

M As Long) As Double

'European Spread Option by Monte Carlo with Black-Scholes

'Clewlow/Strickland: Implementing Derivatives Models, page 110

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nu1dt As Double, nu2dt As Double

Dim sig1sdt As Double, sig2sdt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e1 As Double, e2 As Double

Dim z1 As Double, z2 As Double

Dim St1 As Double, St2 As Double

Dim CT As Double

Dim SD As Double, SE As Double

Dim srho As Double

Dim i As Long, j As Long

'Precompute constants

dt = T / N

nu1dt = (r - div1 - 0.5 * sig1 ^ 2#) * dt

nu2dt = (r - div2 - 0.5 * sig2 ^ 2#) * dt

sig1sdt = sig1 * Sqr(dt)

sig2sdt = sig2 * Sqr(dt)

srho = Sqr(1# - rho ^ 2#)

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

St1 = S1

St2 = S2

For i = 1 To N

'For each time step

e1 = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e2 = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

' e1 = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

' Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

' e2 = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

' Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

z1 = e1

z2 = rho * e1 + srho * e2

St1 = St1 * Exp(nu1dt + sig1sdt * z1)

St2 = St2 * Exp(nu2dt + sig2sdt * z2)

Next i

CT = St1 - St2 - K: If CT < 0# Then CT = 0#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Spread_bMCBS = sum_CT / M * Exp(-r * T)

End Function

Function European_Spread_bMCBS_SV( _

K As Double, _

T As Double, _

S1 As Double, _

S2 As Double, _

sig1 As Double, _

sig2 As Double, _

div1 As Double, _

div2 As Double, _

alpha1 As Double, _

alpha2 As Double, _

Vbar1 As Double, _

Vbar2 As Double, _

xi1 As Double, _

xi2 As Double, _

rhoz As Variant, _

r As Double, _

N As Long, _

M As Long) As Double

'European Spread Option by Monte Carlo with Black-Scholes and Stochastic Volatilities

'Clewlow/Strickland: Implementing Derivatives Models, page 113

'Excel VBA implementation by Bernd Plumhoff 14-Apr-2023 PB V1.0

Dim dt As Double

Dim xi1sdt As Double, xi2sdt As Double

Dim alpha1dt As Double, alpha2dt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim LnS1 As Double, LnS2 As Double

Dim LnSt1 As Double, LnSt2 As Double

Dim v1 As Double, v2 As Double

Dim vt1 As Double, vt2 As Double

Dim z1 As Double, z2 As Double

Dim St1 As Double, St2 As Double

Dim CT As Double

Dim SD As Double, SE As Double

Dim sdt As Double

Dim i As Long, j As Long

Dim z As Variant

'Precompute constants

dt = T / N

alpha1dt = alpha1 * dt

alpha2dt = alpha2 * dt

xi1sdt = xi1 * Sqr(dt)

xi2sdt = xi2 * Sqr(dt)

sdt = Sqr(dt)

LnS1 = Log(S1)

LnS2 = Log(S2)

v1 = sig1 * sig1

v2 = sig2 * sig2

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

LnSt1 = LnS1

LnSt2 = LnS2

vt1 = v1

vt2 = v2

'Generate correlated normals

z = RandCorr(N, rhoz)

For i = 1 To N 'For each time step

'Simulate variances first

vt1 = vt1 + alpha1dt * (Vbar1 - vt1) + xi1sdt * Sqr(vt1) * z(i, 3)

vt2 = vt2 + alpha2dt * (Vbar2 - vt2) + xi2sdt * Sqr(vt2) * z(i, 4)

'Simulate asset prices

LnSt1 = LnSt1 + (r - div1 - vt1 / 2#) * dt + Sqr(vt1) * sdt * z(i, 1)

LnSt2 = LnSt2 + (r - div2 - vt2 / 2#) * dt + Sqr(vt2) * sdt * z(i, 2)

Next i

St1 = Exp(LnSt1)

St2 = Exp(LnSt2)

CT = St1 - St2 - K: If CT < 0# Then CT = 0#

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

Next j

SD = Sqr(sum_CT * sum_CT / M - sum_CT2) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Spread_bMCBS_SV = sum_CT / M * Exp(-r * T)

End Function

Function European_Down_and_Out_Call_bMCBS( _

K As Double, _

T As Double, _

S As Double, _

sig As Double, _

r As Double, _

div As Double, _

H As Long, _

N As Long, _

M As Long) As Double

'European Down and Out Call Option by Monte Carlo with Black-Scholes

'Clewlow/Strickland: Implementing Derivatives Models, page 116

'Excel VBA implementation by Bernd Plumhoff 02-Jan-2022 PB V1.0

Dim dt As Double

Dim nudt As Double, sigsdt As Double

Dim lnS As Double, lnSt As Double

Dim sum_CT As Double, sum_CT2 As Double

Dim e As Double

Dim St As Double, CT As Double

Dim SD As Double, SE As Double

Dim i As Long, j As Long

Dim bBarrierCrossed As Boolean

#If MODULE_TEST Then

e = Rnd(-1)

Randomize 1 'maybe even additional parameter to function

#End If

'Precompute constants

dt = T / N

nudt = (r - div - sig * sig / 2#) * dt

sigsdt = sig * Sqr(dt)

sum_CT = 0#

sum_CT2 = 0#

For j = 1 To M

'For each simulation

St = S

bBarrierCrossed = False

For i = 1 To N

'For each time step

' e = Application.WorksheetFunction.NormSInv(Rnd()) 'Standard normal sample

e = Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + Rnd() + _

Rnd() + Rnd() + Rnd() + Rnd() - 6# 'Standard normal sample

St = St * Exp(nudt + sigsdt * e) 'Evolve the stock price

If St <= H Then

bBarrierCrossed = True

Exit For

End If

Next i

If bBarrierCrossed Then

CT = 0#

Else

CT = St - K

If CT < 0# Then CT = 0#

End If

sum_CT = sum_CT + CT

sum_CT2 = sum_CT + CT * CT

Next j

SD = Sqr(Abs(sum_CT * sum_CT / M - sum_CT2)) * Exp(-2# * r * T) / (M - 1) 'Standard deviation

SE = SD / Sqr(M) 'Standard error

European_Down_and_Out_Call_bMCBS = sum_CT / M * Exp(-r * T)

End Function

Download

Bitte den Haftungsausschluss im Impressum beachten.

Clewlow_Strickland_Implementing_Derivatives_Models.xlsm [96 KB Excel Datei, ohne jegliche Gewährleistung]